|

|

Originally Posted by a500lbgorilla

Please expand upon China's need for a strong US economy.

China purposely depresses their currency strength so that their manufacturing and exports can be strong. The whole "US = made in China" idea depends upon a strong USD and weak yuan in order for cheap production and strong overseas consumption. Any Chinese transition from this will largely rework their entire system and really encourage a strong middle class (which the communists in charge do not want that badly)

Also, a weak USD really screws up Chinese held T$ bills. They effectively lose a crapload of investment due to that investment going down in value. China would effectively be buying high and selling low. Not to mention that US foreign debt is only about 1/3rd of total US debt, and that only a fraction of that is to the Chinese. Nearly every nation holds a lot of US debt relative to their own economic strength. The US is really extremely powerful, but many citizens are told otherwise because that's good politics. We have a stranglehold on the global economy, and if we fall, most of the other first-world and developing economies fall harder. The power is at the top, and the US is not only on top, but chucks lightning bolts upon the mortals on a regular basis

I mean, we're engaged in two fucking wars because we tell the rest of the world that's what's gonna happen. Obviously there are some barriers, but imagine what would happen if France wanted to invade Saudi Arabia like we did Iraq. Big Brother USA would definitely put a stop to it unless it served our interests best. The US is the patriarch of the globe. While other nations are doing their best to rise up, I would not be surprised if the US is still rising even higher. Just like how the rich get richer simply because they're rich, the powerful seem to be in a perpetually better position to get even more powerful. This is done in part by 'outsourcing weakness'. It's common to further prop up a dominant economy by suppressing an already weaker economy. I mean, just look at the history or Haiti or Germany post WWI; more powerful economies imposed debts and sanctions on them which perpetually propped up those powerful economies and perpetually depressed the weak ones. In the case of Germany, the Weimar lost to the Third Reich, and in the case of Haiti, they're so poor that an earthquake destroys their entire nation's infrastructure. Whether we want to admit it or not, wealth is partly a product of stealing from the poor, and we find that in times of trouble, that thievery increases

Krugman thinks that China selling off on a weak dollar would actually benefit the US

http://krugman.blogs.nytimes.com/200...-dollar-panic/

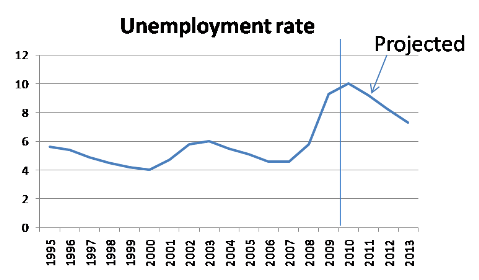

Also, I can't find it, but Krug has posted much on the status of USD as reserve currency and overall very powerful being very solid and built into the system. Panic over US going down relative to other nations is unfounded. This will happen, but over decades, not months or years. I remember watching a panel discussion from economists across the globe during the Wall Street meltdown, and one of the important points made was that the root of the problem of the global economy is global inequality i.e. US over consumes and China over produces, and that if the developed nations were to have more balanced personal economies then the relationships of these nations would not be so intricately dependent upon each other like it is now. Some developed economies are not super dependent on the US/China relationship, but only to a small degree, and as we have seen, the entire globe is literally subservient to the actions of the US financial markets. Not a good paradigm for anybody other than the US bankers IMO, and we've seen this quite clearly over the last year (Wall Street back to making huge profits at the expense of taxpayers while employment continues to decline)

Ironically, Krug's Nobel Prize was awarded for his analysis of the efficiencies of concentrated inequalities.

|

Reply With Quote

Reply With Quote